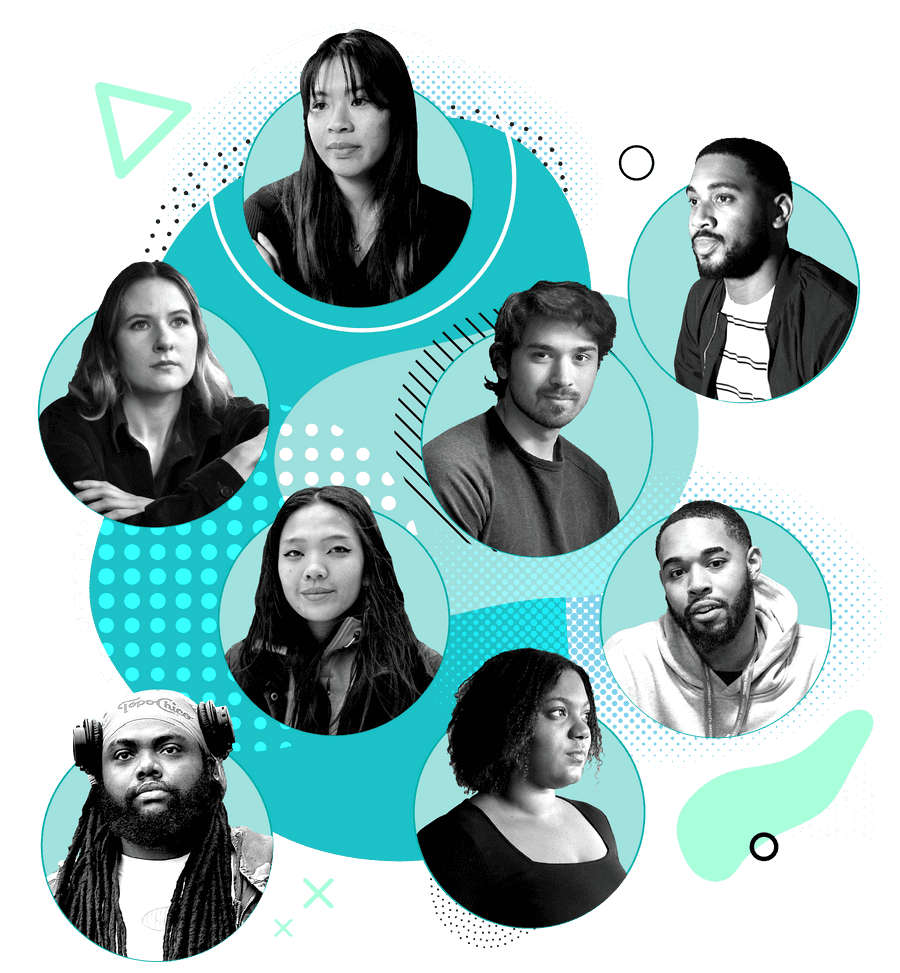

Gen Z — the youngest generation of adults — is grappling with the skyrocketing cost of living in Boston. Rents inch up every year; the typical home sells for $700,000 or more. Student loans and credit card debt linger constantly. And inflation and economic uncertainty easily derail goals to save or invest.

Dozens of people under 25 who spoke with the Globe described being stymied by one obstacle after another despite earnest efforts to put money away for long-term goals. How would you fare in their position?

Toggle the figures below to see how much you need to earn and save to reach basic financial milestones today, like buying a home or having an emergency fund.

Reality check calculator

Select your goal:

What is the price of the house that you would like to purchase?

What percent of the purchase price is the down payment?

Enter your monthly income after taxes:

Enter your monthly expenses:

Adjust your housing costs such as rent, including utilities

Adjust your transportation costs such as auto costs or an MBTA pass

Adjust your health care costs including out of pocket costs and insurance

Adjust your entertainment costs

Adjust your food at home or grocery cost per month

Adjust your other expenses (child care, student loans, etc.)

Buy a home in the Boston area

- Your total monthly expenses are $4,350

At this pace, it will take 18 years (or 216 months) to save up for the 20% down payment of $140,000 for a $700,000 house.

You put $650, or 13% of your income towards the goal.

Methodology: Median income and costs are determined using data from the US Census, MIT's Living Wage calculator, the Bureau of Labor Statistics, and Apartmentlist.com. Results are determined by adding up total expenses, subtracting from income, and applying the difference to the goal on a monthly basis. Debt results also factor in the amortization schedule for the debt amount. Future potential increases in cost of living and earnings are not included in the calculation.

Advertisement

Credits

- Reporter: Diti Kohli

- Editors: Tim Logan, Andrew Caffrey

- Photographers: Barry Chin, Lane Turner, David L Ryan, John Tlumacki, Suzanne Kreiter, and Craig F. Walker

- Photo editors: Leanne Burden Seidel and William Greene

- Digital editor: Christina Prignano

- Design: Ryan Huddle

- Development: Daigo Fujiwara

- Copy editing: Mary Creane

- Digital producer: Dana Gerber

- Audio producer: Jesse Remedios

- Audience engagement: Cecilia Mazanec and Jenna Reyes

- Quality assurance: Nalini Dokula

© 2023 Boston Globe Media Partners, LLC