From left: Former Steward Health Care CEO Ralph de la Torre and Medical Properties Trust founder Edward K. Aldag Jr. (Photo Illustration by Ashley Borg/Globe Staff, Adobe Stock, AL.com, John Tlumacki/Globe Staff)

House of cards: How a real estate firm and Steward Health Care grew in tandem, in part by keeping Steward’s shaky finances secret

VESTAVIA HILLS, Ala. — It felt like the beginning of a beautiful friendship.

When Dr. Ralph de la Torre, a brash and brilliant son of Cuban immigrants, jetted into the Birmingham airport in 2015, he was a man with a vision for the struggling Steward Health Care chain, a new approach that could vault it from its roots as a network of Catholic hospitals in Massachusetts to a for-profit giant of national and even global importance.

He couldn’t do it without money. That’s where a business executive raised in small-town Alabama came in.

Edward K. Aldag Jr. had been inspired to achieve financial success since childhood, when his grandfather, a German immigrant who worked as a locksmith at the New York Stock Exchange, showed him around the place.

“Ed, this is where dreams come true,” his grandfather said, in Aldag’s telling.

Young Ed was listening. After college, and a stint managing real estate firms, he had a eureka moment.

In 2003, he founded Medical Properties Trust, aiming to fill a market niche no other real estate investment trust in the world had thought to claim — hospitals. His brainchild: Make hospitals “asset-light” by buying up their buildings and land and then leasing them back. This would allow health care firms to “unlock the value of their real estate,” according to MPT, by taking cash from the sale and spending it on facility improvements, technology upgrades, staffing, and growth. With hospital operators left to focus on health care, MPT could sit back and collect rent — yielding hefty profits for years.

Aldag and his inner circle would get extraordinarily rich along the way.

It was a persuasive pitch, and MPT, which by 2005 was traded on the stock exchange where Aldag’s grandfather had worked, grew quickly. By the time Aldag and de la Torre met in 2015, MPT had about $4 billion in assets. Today, it is the largest hospital landlord in the United States, and the second biggest private owner of hospitals in the world. MPT owns 435 properties worth more than $16 billion, including 42,000 hospital beds in nine countries — making it a huge force in medicine.

“Every time we’ve been able to sit down with a CFO of a hospital and walk through this model, we’ve been able to win the financing of it,” Aldag said in a 2011 speech.

In 2015, Aldag and de la Torre were both around 50 and at a similarly critical juncture in their lives — ready, at mid-career, to go big with their dreams. De la Torre’s goal for Steward was nothing short of “world domination,” according to an internal MPT email reviewed by the Globe. Aldag was looking to turbocharge the already rapid growth of his firm.

The two “hit it off immediately,” according to an MPT annual report. Aldag and de la Torre “felt destined to work together.”

For the next nine years, the high-flying CEOs and their firms would take an extraordinary entrepreneurial journey, their fortunes intertwined, their ascent breathtaking.

MPT financed Steward’s expansion across the country, buying hospitals at premium prices. Steward soon became the country’s largest private for-profit health system, and by far MPT’s biggest single investment and source of revenue.

But behind the scenes, little was as it appeared. Steward began to founder under the weight of the new rent payments and eventually started cutting corners on the basic expenses of medicine — nurses, equipment, maintenance — putting patients at risk. MPT couldn’t afford to let its biggest tenant fail, so it intervened in substantial, sometimes secretive ways to funnel money to Steward and bolster its balance sheet.

Signs were put up and chairs barricaded the emergency department doors after the final closing on the last day at the emergency department at Carney Hospital in Dorchester. (Kayla Bartkowski For The Boston Globe)

Carney Hospital lead department secretary Maryanne Murphy (right) hugged her co-worker Scott Beckman on the last day at the emergency department at Carney. (Kayla Bartkowski For The Boston Globe)

Finally came the steep financial fall of recent months, with hospitals closing, communities desperate for health care, and both companies facing public condemnation. De la Torre recently resigned as Steward’s chairman and CEO; Aldag remains on top at MPT. But their wild ride together is over.

The Boston Globe Spotlight Team has spent months investigating this unusual partnership to lay bare another critical piece of the Steward saga.

Among the team’s findings: MPT and Steward, which were supposed to operate at arm’s length, instead often operated in concert. MPT — which in addition to being Steward’s landlord was a creditor and minority owner — quietly routed money to Steward, helping its biggest tenant make rent payments. MPT hid Steward’s ailing financial health from investors, which may have bolstered its bottom line, but may have also violated federal securities laws, according to experts and analysts who spoke to the Globe.

Citing the circular transactions, some observers have likened the entire arrangement to a Ponzi scheme. The question, as with all Ponzi-like ventures, was how soon and how badly it would end.

Steward and MPT were able to keep the house of cards they built standing for nearly a decade. Over that time, Aldag and de la Torre steered tens of millions of dollars into their own pockets, even as Steward sank into bankruptcy and MPT’s stock price collapsed.

This story draws on dozens of interviews, including seven with former MPT and Steward executives and employees, as well as in-depth property data analyses and a trove of tens of thousands of confidential financial documents and internal emails obtained by the Globe Spotlight Team and the Organized Crime and Corruption Reporting Project, a global journalism outlet.

Advertisement

Steward and de la Torre, whom the Senate voted unanimously last month to hold in criminal contempt of Congress, have come in for most of the public opprobrium as Steward’s hospitals withered or closed. But the Spotlight Team’s investigation shows that this unprecedented crisis and alleged profiteering would not have been possible without the extraordinary financial backing of MPT and Aldag.

This “appears to me to be serious white-collar crime,” said Steve Weisman, an attorney and expert on financial scams who teaches at Bentley University and has followed the Steward saga. Weisman likened MPT’s activities with Steward “to the type of accounting fraud perpetrated by executives at Enron.”

“They make the hospitals look profitable when they’re not,” said Weisman. “It very much is all smoke and mirrors.”

MPT spokesperson Drew Babin called the Globe’s findings “false and misleading” and said MPT had no direct influence over Steward’s day-to-day operations, with its role primarily limited to that of landlord.

“Over the years, MPT has occasionally stepped in to provide bridge loans, rent deferrals, and other forms of financing when no other party was willing to because we have always believed Steward’s hospitals are critical to the healthcare of their communities,” Babin said. “MPT stands firmly behind our rigorous underwriting process as well as the completeness and accuracy of our disclosures. We have unfailingly disclosed each of our transactions — including those with Steward — as and when required under applicable securities law.”

“They make the hospitals look profitable when they’re not. ... It very much is all smoke and mirrors.”—Steve Weisman, senior lecturer, law and taxation, Bentley University

Aldag declined to speak with a reporter who sought him at his office and home in Alabama.

Steward declined to comment. De la Torre said through a spokesperson that the Globe’s findings contained “factual inaccuracies,” and that he believed eight years ago — and still believes — that partnering with MPT was the most viable option for Steward.

It “was a prudent decision to choose the asset-light REIT model in 2016 over private equity alternatives because the former represented a long-term capital partner whose returns on investment were conditioned upon Steward’s continued success,” said his spokesperson, Rebecca Kral. After exploring “a multitude of options,” Kral said, de la Torre decided “the best way, and likely the only way, to generate necessary capital for the Steward hospital network at the time was through the 2016 sale-leaseback.”

A pattern of overpayment

In 2016, just over a year after de la Torre and Aldag first met in Alabama, MPT made a spectacular deal for Steward’s real estate. The prices were astonishingly high. For Steward’s nine Massachusetts hospital campuses, MPT would pay nearly $1.3 billion, nine times what Steward had paid less than a decade earlier.

For example, MPT paid Steward $263 million for Carney Hospital in Dorchester — 21 times what Steward had paid in 2010.

If the transactions appeared illogical, there was a method to the madness: The sellers got rich, and the value of MPT’s portfolio soared.

A huge chunk of the money for MPT’s 2016 purchase of the Massachusetts hospitals, for instance, was converted into a payout for Steward’s then-owner — the private-equity firm Cerberus Capital Management.

Cerberus got the lion’s share of the $790 million, allowing it to recoup its initial investment in Steward plus a profit of $473 million, according to Cerberus. De la Torre reaped his own considerable payday for his share of the firm.

For MPT, the massive deal and its jaw-dropping price markups also had upsides. The company’s growth had long been fueled by vast sums of money from Wall Street and lenders. The Steward acquisition allowed the firm to announce it had booked another long-term tenant — one that would be paying hundreds of millions of dollars in rent over the decade-plus ahead.

After the Massachusetts purchases, more deals quickly followed. MPT financed Steward’s expansion into states including Florida, Ohio, Texas, and Utah. The pattern of overpayments continued. While national sales data are spotty, a Spotlight Team analysis of more than two dozen Steward hospitals shows that MPT paid over three times the total value that had been assigned to the hospitals by local tax assessors.

The dynamic was perhaps captured most neatly in a pair of transactions in West Texas. On one day in April 2019, Steward bought a hospital in Big Spring for $11.7 million. That same day, MPT bought the building and the land it sits on from Steward for more than twice as much: $26 million.

Such overpayments almost certainly did damage to MPT’s long-term health. But they paid off handsomely in the short run for Aldag and other top executives, whose compensation was linked for years to the size of the deals they closed, according to filings with the Securities and Exchange Commission.

Last year, Aldag’s compensation reached a high-water mark of $17.85 million, an SEC filing shows. Over the last two decades, Aldag and two other MPT cofounders — chief financial officer R. Steven Hamner and retired chief operating officer Emmett E. McClean — were collectively granted compensation of more than $300 million.

Advertisement

Babin, the MPT spokesperson, said the company’s executive compensation plan is closely aligned “with shareholder interests,” adding: “Over the last two years, executive pay has been significantly impacted by stock price performance.” He cited an SEC filing that said with more than 80 percent of CEO compensation tied to stock price, the amount “actually paid” to Aldag in that span was far less.

While top executives netted huge payouts, it was obvious to some MPT employees that the fundamentals of the company’s deals often made no sense.

Four former MPT employees told the Globe that many company acquisitions were based not on due diligence or careful underwriting, but on executives’ desire for high-dollar deals and more properties.

The goal was “pure growth, growth at all costs,” explained Alex Hubartt, a former MPT financial analyst. “Whatever direction came from the leadership, regardless of what the numbers say, you’ll find a way to get it done.”

Another former employee, who spoke on the condition of anonymity for fear of repercussions, put it plainly.

“Everybody wins with the highest price,” the employee said. “That was the goal: How do we maximize the rent stream?”

The employee added that company analysts were sometimes pressured to sign off on deals even when the values were “insane.”

To what end?

“The bottom line of all this is greed,” said a former MPT executive, who also spoke on condition of anonymity. “Greed motivates individuals.”

A circular relationship

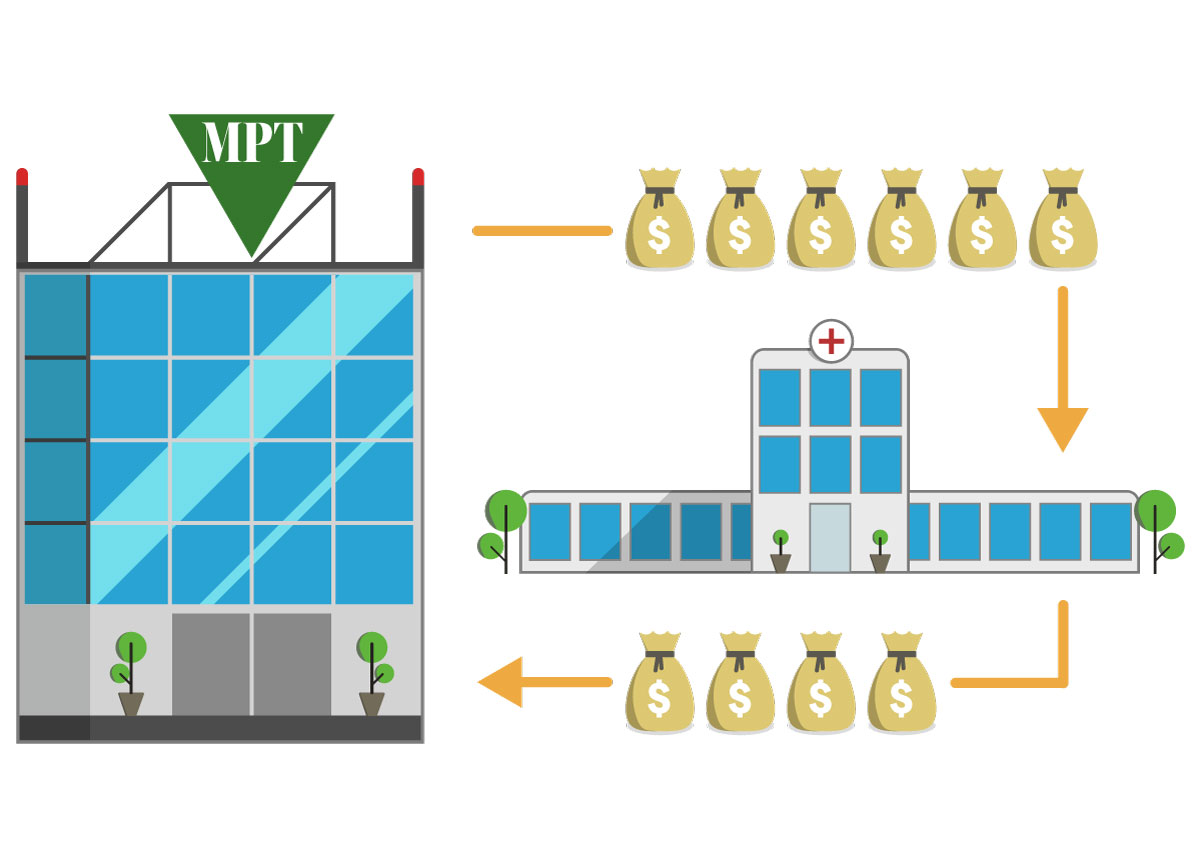

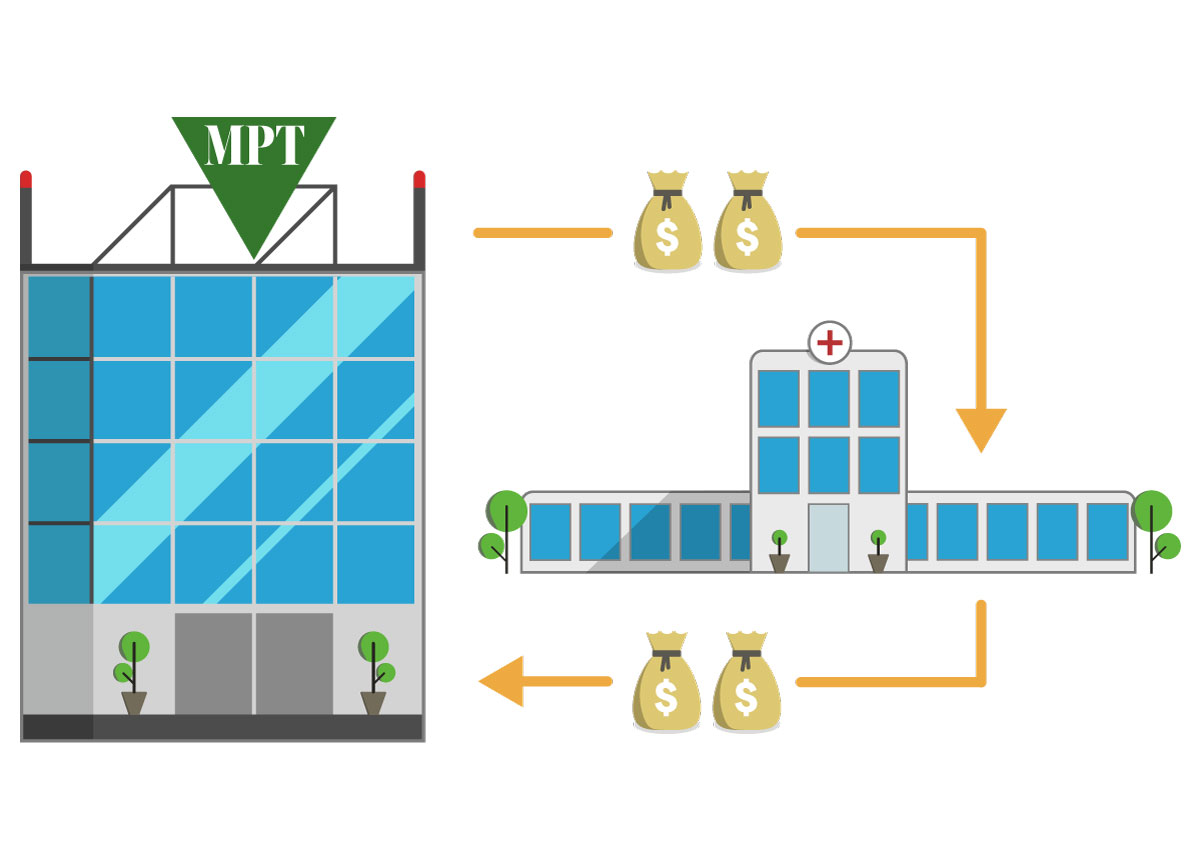

How some real estate deals between Steward and MPT worked.

Steward then sold the hospitals and land to MPT at inflated prices. MPT leased them back to Steward at exorbitant rates.

As Steward struggled, MPT funneled money to Steward, helping it cover unaffordable rents.

While MPT financed Steward’s expansion, MPT’s assets and stock price grew.

From their deals, MPT and Steward executives steered tens of millions of dollars into their own pockets.

Signs of trouble

It didn’t take long for cracks to appear in the shiny facade Steward and MPT had constructed.

Steward posted heavy losses in 2017 and 2018.

The red ink should have been predictable. Steward’s hospitals tended to serve working-class people, many of them on Medicaid, whose payments often lag far behind costs, and some uninsured. The company billed itself as focused on underserved and rural communities and “leading the way for a remarkable new world of access to affordable, high-quality care for every human being.” It was not a formula for generating the kinds of returns Steward would need to pay millions in rent, a huge expense after Steward sold its real estate.

Whether or not the financial strategists at Steward and MPT knew, at the outset, the risks of what they were doing is impossible to determine. But it’s clear both parties understood early on that Steward was in trouble. Their solution was to hide it behind MPT’s cash infusions and bullish claims. MPT investors had no way to know how badly things were going.

There was no turning back. The fortunes of MPT and Steward were now inextricably bound together.

MPT first took a 5 percent stake in Steward when it made the 2016 Massachusetts real estate deal. With the multistate Steward expansion that followed, MPT’s stake grew to 9.9 percent — just below the maximum allowed under federal laws aimed at ensuring real estate trusts aren’t too reliant on a particular tenant.

By then, MPT had become heavily dependent on its biggest renter. According to a quarterly MPT report, Steward hospitals by early 2019 made up 38 percent of MPT’s assets and a whopping 44 percent of its revenue.

At MPT, things had long appeared to be going swimmingly, at least on paper. The company’s assets more than doubled between 2016 and 2019, and its stock price rose by almost 70 percent. But its success was at great risk if the troubled state of Steward’s finances became public.

Their futures interlinked, the companies were about to launch their boldest gambit.

An unholy resurrection

In 2020, Steward was facing its worst year yet, with an expected loss of about $400 million, according to internal documents.

But MPT’s leaders couldn’t let Steward crumble. So they concocted a secret rescue plan, dubbed “Project Easter,” documents show. Through a complex web of transactions that hid the scheme’s intent, MPT would “infuse $400 million of ‘new’ capital into Steward” to “assure Steward has adequate liquidity,” according to a confidential MPT board presentation, masking Steward’s financial problems and by extension MPT’s.

The “recapitalization” plan, as MPT privately called it, would also free Steward from its corporate parent, Cerberus, and its restrictions. MPT loaned $335 million to de la Torre and fellow Steward executives to help them buy out Cerberus. In 2021, Cerberus walked away with a total profit of $800 million, the company has said.

MPT also signed off on a payout of $111 million to Steward’s shareholders, with de la Torre — now the majority owner — getting about three-quarters of it, according to internal Steward documents reviewed by the Globe. MPT itself got $11 million.

Critics in Congress and elsewhere have questioned the ethics of such individual enrichment in the face of so much financial wreckage. But the rest of the scheme was just as troubling. Simply put, Project Easter was a circular transaction — a landlord giving a tenant money that helped it pay rent, and then recouping it. It was a lie.

That may be one reason MPT took pains to disguise what it was up to. Rather than making a straightforward transaction, the firm routed the money into joint ventures. It provided half of its $400 million capital infusion in exchange for an international Steward subsidiary that had “negative cash flow,” according to a confidential Steward board presentation reviewed by the Globe.

MPT conjured the other $200 million by converting the mortgages on two Utah hospitals to leases, and paying Steward an “additional cash consideration” based on what MPT later described as the hospitals’ “relative fair value.” MPT said they were worth a stratospheric $950 million, then hired appraisers “with clear and appropriate instructions” to reach “a high level estimate,” according to internal emails.

The entrance to Medical Properties Trust's current headquarters in the Birmingham suburb of Vestavia Hills, Ala., about a mile away from the 54-acre site where the company's $150 million future home is under construction. (CATHERINE CARLOCK / GLOBE STAFF)

The entire plan enabled MPT to shroud Steward’s insolvency. In public statements and in federal securities filings, MPT never called it “Project Easter,” and the effort was portrayed as a series of disparate transactions, not a carefully coordinated effort to keep its largest tenant afloat.

Documents reviewed by the Globe and interviews with former MPT employees make clear the real estate firm had long known it was papering over problems.

At MPT, there were “lots of inside remarks about Steward always needing money, always coming to MPT for money,” said Cassi Marshall, a former MPT risk analyst. “You can call it a loan, but if I know your financial situation and I loan you money, I don’t know that I expect to get it back.

“Everybody at MPT knew Steward’s financial situation,” she added. “It was a running joke.”

One major way that MPT kept Steward afloat was to quietly fund its faltering tenant, as it did with Project Easter. Last fall, amid mounting questions from analysts and investors about the company’s circular financial dealings, MPT released a video in which Aldag cast a benign light on the aid his firm sent to tenants such as Steward.

“There are times when high-quality hospital operators experience short-term financial challenges caused by unexpected events,” Aldag explained. “In these rare situations, MPT will sometimes step in to provide temporary, limited support through working-capital loans. These loans … are certainly preferable to permanently cutting rent.”

But MPT’s support could hardly be called “temporary” or “limited.”

Over half a dozen years, MPT pumped more than $1.5 billion into Steward through a series of loans, equity deals, and other transactions, according to a Globe analysis of Steward bankruptcy documents, SEC filings, and internal records. That works out to more than six years of rent and interest payments from Steward, and it’s about three-quarters of the total rent and interest collected from Steward over the life of the two firms’ relationship, according to MPT.

Steward’s need for money could be urgent. One stark example came in 2022, when Steward’s chief financial officer said he had “reached his limit with vendors” and demanded MPT wire Steward $75 million by “tomorrow,” according to an MPT email reviewed by the Globe.

Acquisitions could also be a way to channel funds to Steward. The 2019 hospital purchase in West Texas was one example. That same year, Aldag emailed de la Torre about a potential project in Turkey. Though it never panned out, he said he was considering another infusion of money.

“I am trying different scenarios to get the maximum amount of cash to you guys,” Aldag wrote. “I am trying to come up with a structure that we can pay you (Steward) for the real estate over and above what we pay Turkey.”

“I am trying different scenarios to get the maximum amount of cash to you guys.”—MPT founder Edward K. Aldag Jr., in an email to Steward CEO Ralph de la Torre

MPT said Steward repaid some of its loans, in whole or in part. But as a publicly traded company, MPT may have violated federal securities laws, legal and financial experts say, by quietly propping Steward up and misrepresenting its financial health to investors.

Internal emails reviewed by the Globe make clear MPT wanted to keep its investors in the dark. For instance, as they prepared for a call with investors and analysts after their launch of Project Easter in 2020, Aldag and other company leaders circulated talking points, including a list of “THINGS WE WILL NOT COMMUNICATE.” Among them: “Steward valuation math” and the word “recapitalization.”

Aldag was breezy and optimistic in an earnings call later that year, telling listeners: “Our operators are performing beautifully across the world.”

Advertisement

Two years later, in 2022, Aldag again brushed off questions about Steward’s faltering finances. “Steward has always performed well at the hospital level,” he told an interviewer. “All of the bad is behind Steward.”

Steward’s bankruptcy filing was less than two years away.

As late as February 2024 — just over two months before Steward went bust — Aldag was assuring nervous investors in an earnings call that Steward would be able to start paying full rent starting in June. “We’ve been getting weekly cash flow reports from Steward’s advisers,” he said, “to which they’ve exceeded every one of them thus far.”

By then, Rob Simone of the investment research firm Hedgeye Risk Management, one of MPT’s earliest and most outspoken critics, was sounding the alarm; he had, in fact, been issuing emphatic warnings for two years, and had advised investors to short the stock.

“It’s the biggest fraud that hardly anyone knows about,” Simone said in an interview. “The entire company story — the narrative, and now the numbers themselves — is basically a giant bluff.

“While they are telling people — investors, the media, analysts — that things are always getting better … it just keeps getting worse. The lies get bigger, and the misrepresentations get more preposterous. And eventually the lies fall in on themselves.”

The reckoning

In January 2022, MPT’s stock hit a peak. A long slide soon began, as some tenants’ struggles started to come into view, and short sellers and other analysts began raising increasingly urgent questions about the stability of the whole enterprise.

By the time Steward declared bankruptcy in May 2024, shares of MPT had fallen by more than 80 percent. They’ve since inched up slightly, but MPT’s long-term future appears uncertain. The firm’s credit has been downgraded to “junk bond” status.

Steward’s bankruptcy filing showed it was on the hook for $6.6 billion in future rent payments to MPT, a debt that will never be paid. It’s a huge number, even for a firm, like MPT, with assets estimated at about $16 billion.

The once-cozy relations between MPT and its biggest tenant have soured. Steward complained in filings that onerous leases had “crippled” its hospital operations, and it attacked MPT’s “self-interested involvement and interference” in hospital sales.

MPT suggested Steward had only itself to blame. “Rent is virtually never the primary cause of financial stress for hospitals,” it said in a public statement. Left unsaid: Many hospitals don’t pay rent in the first place.

Now billions of dollars in debt, MPT is trying to persuade Wall Street that it can surmount the crushing losses set in motion by Steward’s slide into bankruptcy. One show of confidence: Construction is well underway on a sleek new $150 million headquarters in Vestavia Hills, just outside Birmingham. Last month, the firm trumpeted the news that it had agreed to long-term leases with new tenants for a passel of former Steward hospitals.

But the same press release acknowledged that MPT’s new tenants won’t pay a dime of rent for the rest of 2024. By the end of next year, they’ll pay just half of their eventual projected rent. The announcement was greeted with some skepticism by analysts, including Hedgeye’s Simone, who opined: “The math does not work.”

As MPT scrambles to right itself, shareholders have filed nearly a dozen lawsuits alleging securities fraud and other malfeasance.

John Cuomo, 62, of Las Vegas, a retired forklift mechanic, is the lead plaintiff in one class-action lawsuit. He stated that he lost about $182,000 on MPT stock because of the company’s subterfuge.

Steady growth, and then a freefall

As MPT became the largest hospital landlord in the United States, its stock price soared. But it tumbled amid questions about its business practices.

- MPT stock price

Joseph Crognale, 27, of Dedham, an engineer with a couple thousand dollars worth of MPT shares, also filed suit.

“I thought it was a great investment, and then everything started tanking,” Crognale said. His suit accuses MPT executives and board members of breaching their fiduciary duty and says some unjustly enriched themselves using “nonpublic information to sell their personal holdings” while MPT stock was “artificially inflated.”

For MPT, “there is certainly a real chance of liability” for securities fraud, according to John C. Coffee Jr., a Columbia University law professor and authority on securities law and white-collar crime. He cautioned via email, however, that MPT “can escape liability if it can convince a jury that Steward Health Care’s decline was not fully (or adequately) understood by it.

“Do not assume that this is a slam-dunk case,” Coffee added. “Truth and what can be proven in court are two spheres that overlap only marginally, like Venn diagrams.”

MPT, meanwhile, has filed its own defamation lawsuit against Viceroy Research, a short-selling financial research group that has criticized MPT for possible fraud. The MPT lawsuit is “illogical and farcical,” said Fraser Perring, a British financial analyst and founder of Viceroy. “It’s 100 percent malicious.” A judge denied Viceroy’s motions to dismiss the case.

In addition to litigation, both Steward and MPT face heavy scrutiny from Congress and federal agencies.

Steward’s implosion has triggered congressional hearings, and a Senate committee chaired by Vermont Senator Bernie Sanders is exploring the causes of Steward’s bankruptcy. Also, a federal grand jury in Boston is asking questions and seeking records about Steward’s relationship with MPT, according to people familiar with the inquiry. And the SEC has repeatedly sought information from MPT, including Steward’s audited financial statements. MPT has said it was willing to supply the files, but doesn’t have them.

In response to a Globe request for documents pertaining to possible investigations of MPT, the SEC said it was withholding records from the newspaper under an exemption that “protects from disclosure records compiled for law enforcement purposes, the release of which could reasonably be expected to interfere with enforcement activities.” It added that the reference to law enforcement did not necessarily indicate any violations of law.

In April, Massachusetts Senators Elizabeth Warren and Edward Markey wrote that MPT’s “investments have all the appearances of a Ponzi scheme that is continuing to harm Steward-owned hospitals.”

They have introduced legislation that would impose new restrictions on real estate investment trusts in the medical sector.

“MPT, along with other corporate vultures, plundered Steward’s Massachusetts hospitals and drove them into bankruptcy,” Warren said in a statement provided to the Globe last month. “After Ralph de la Torre and Cerberus sold the land from under the hospitals to make a fat profit, MPT saddled the hospitals with onerous leases and ran what looked like a Ponzi scheme. Ultimately, this looting caused the hospital system to fail and patients to suffer.”

Their outrage continues unabated despite de la Torre’s recent exit from Steward, and Steward’s from Massachusetts. With federal probes pending, full accountability has not yet been assessed.

Some of the most passionate testimony at a recent Senate committee hearing came from Louisiana state Representative Michael Echols, whose Monroe-area district is near Glenwood Regional Medical Center — perhaps Steward’s most troubled hospital.

At least six patients unnecessarily died at Glenwood because of Steward’s failure to uphold basic standards of medicine, according to earlier reporting by the Spotlight team.

Echols, a Republican who has worked in the health care industry, told the committee that MPT and Steward had “facilitated a Ponzi-like scheme” and urged the federal government to take steps to prevent a repeat.

“These have been fraudulent activities. They’ve killed my constituents,” Echols said in an interview with the Globe, speaking of the two firms. “They are health care terrorists of the highest order, and I want to make sure that they never get to come back to my state.”

Khadija Sharife of the Organized Crime and Corruption Reporting Project contributed to this report. Rebecca Ostriker can be reached at [email protected]. Follow her @GlobeOstriker. Catherine Carlock can be reached at [email protected]. Follow her @bycathcarlock.

Credits

- Reporters: Rebecca Ostriker and Catherine Carlock

- Contributors: Khadija Sharife of the Organized Crime and Corruption Reporting Project

- Editors: Gordon Russell, Mark Morrow, Brendan McCarthy

- Photos: Kayla Bartkowski For The Boston Globe, Catherine Carlock

- Director of photography: Bill Greene

- Photo editor: Kevin Martin

- Design: Ashley Borg and John Hancock

- Development and graphics: John Hancock

- Digital editor: Christina Prignano

- Copy editor: Mary Creane

- Audience: Cecilia Mazanec

© 2025 Boston Globe Media Partners, LLC