Beyond the gilded gate:

The $600,000

problem

Why does it cost so much to

build in Greater Boston,

and what can be done?

Many forces drive the housing crisis here, and the sky-high cost of construction is one of the most powerful

Somerville

On a gray morning this month, a construction worker in a neon vest knelt with his tools in a concrete foundation dug into a hillside on the western edge of Somerville, literally laying the groundwork for a project that could help change the way housing gets built around here.

At the same time, 25 miles away in a factory in Littleton, some of the 168 apartments that will soon rise from this foundation were being hammered together, piece by piece.

This 12-story building underway in Somerville’s Clarendon Hill public housing complex is one of the most ambitious experiments in factory-built — or “modular” — housing in New England. By building the apartments — including kitchens and bathrooms — offsite and then stacking them like Legos on this sliver of land, this project’s developers say they’ll deliver it 40 percent faster, for substantially less cost, than a similar-sized building they’re constructing the typical way in Boston.

The ceiling of a modular unit was guided into position at Lab 9 Modular in Littleton, where a 12-story apartment is being built piece by piece and will be trucked to a site in Somerville for assembly early next year. (Lane Turner/Globe Staff)

In a business where time is money, that’s a huge difference, the sort of factor that just might jumpstart construction and begin to put a dent in the region’s massive housing shortage. Aaron Gornstein, a former top state housing official who now leads POAH Inc., the developer of Clarendon Hill, said this approach could be a game-changer. If it can be repeated elsewhere.

“And we don’t know that yet,” he said.

The modular high-rise in Somerville represents one of a growing number of experiments to tackle an overlooked but increasingly dominant force behind Greater Boston’s astronomical rents and home prices: the enormous cost of new construction.

New housing often costs $500,000 to $600,000 per unit to finance and build, with high-rises closer to downtown Boston costing even more. Those numbers are baked in from the start, setting a floor on future rents before the first shovel even hits the ground.

And they’re a big reason why building our way out of the housing crisis that’s gripping Greater Boston has proven to be so hard.

Even as towns all over the region finally wrestle with their own histories of blocking the sort of multifamily housing that regular people can afford — the sort Massachusetts desperately needs to preserve its middle class and maintain a vibrant economy — the cost to build that housing has steadily climbed. Land, key materials, borrowing money itself, they’ve all surged in price. While new mandates for affordable housing and green energy aim to address long-term challenges, they too come at a cost. Those costs translate into rents, which even in this sky-high market have their limits — the point at which potential renters will go elsewhere.

All the rezoning in the world won’t spark a wave of new housing if people can’t make money building it. And, right now, some 30 developers, construction executives, architects, and policymakers told the Globe Spotlight Team, they can’t make the numbers work. It is a troubling conclusion that leads some in the industry to wonder if it’s time to boldly rethink how we build housing to begin with.

For all their present challenges, most of the last quarter-century has undeniably been kind to developers in Boston.

Thanks to ever-increasing rents and land values, owning an apartment building can be a lucrative proposition. Builders have made huge sums by selling projects at the right time and many a generational fortune has been amassed by holding real estate long term.

But the act of building housing can be a tightrope walk, with countless ways to slip up and profit margins that can be slim and unpredictable, especially in the early years. That’s a challenge for developers who need to attract big investors — pension funds and private equity, life insurers and banks — who put up the cash to build projects in the first place and who have a world of options for where to direct their money and will invest elsewhere if they can’t get the return they need here.

The increase in costs comes as Massachusetts is finally making progress on zoning, with the MBTA Communities law forcing many long-reluctant suburban towns to allow more multifamily housing, said Rachel Heller, a longtime Beacon Hill housing advocate. Her organization, the Citizens’ Housing and Planning Association, estimates Massachusetts needs 200,000 new units through 2030 or about 25,000 a year. Through October, barely more than 10,000 building permits have been issued across the state this year, according to the Census Bureau. If nothing changes, next year could see even fewer.

“It’s definitely a game of whack-a-mole,” Heller said. “Financing has always been a challenge but the biggest challenge had been zoning. Now, zoning is being put in place but at the same time every other cost is going up.”

Advertisement

Any developer will tell you building apartments boils down to a simple equation: Can the project bring in enough rent to cover the cost of construction and generate enough profit to attract investors?

If it can, more people get someplace to live. If not, well, nothing happens.

“For me, the math is just math,” said Gary Kerr, managing director in the Boston office of Greystar, one of the country’s largest apartment developers. “We have to make the math work.”

To solve that equation, developers puzzle over dozens upon dozens of variables. But most budgets boil down to a few major ingredients — the biggest being “where,” “what,” and “who.”

“Where,” of course, is land.

The cost of buildable sites in and around Boston can vary widely, but it’s among the highest in the country. These days, a typical site suitable for mid-rise housing in the outer neighborhoods of Boston or its inner suburbs might cost $40,000 to $80,000 per unit, just for the dirt. That number has jumped in recent years as life science projects — which typically command higher rents than housing — have spread across the region.

Then comes materials, or what goes into a project.

A new building needs tons of cement and steel, wood and copper wire. These are basic commodities that trade on global markets, so when China launches a building spree or Russia invades Ukraine, their prices go up.

Every major ingredient of a multifamily building costs more than it did before COVID, according to the National Multifamily Housing Council; copper prices alone are up 43 percent. Equipment and systems such as HVAC, too, can take far longer to acquire, thanks to global supply shortages and growing demand for costly components.

Ordering an electrical system for a mid-sized apartment building might take 80 to 85 weeks right now, said Ryan Jennette, director of operations at construction firm Consigli in Boston. That’s more than twice as long as it used to, complicating an already-complex construction schedule. After all, you can’t put up the drywall before the wiring’s in place.

“It’s a snowball effect,” Jennette said.

Buildings need builders, too.

A small army of laborers and carpenters, plumbers and electricians helps erect every new building. In Boston, many are unionized, at least on larger projects, with total pay and benefits averaging $72 an hour in Massachusetts, according to the Construction Labor Research Council. That’s $10 an hour more than the national average for union workers and roughly one-third higher than non-union labor in Greater Boston, industry experts say.

Every new project needs a small army of construction workers to build it. Workers at sites in Everett and Revere that started construction before interest rates soared. ( David L. Ryan/Globe Staff)

The unions contend their workers are more productive and reliable, and some builders agree. A few unions, including the Carpenters, offer a lower wage rate for apartment projects than for commercial construction. Technological advances have made building more efficient, reducing overall hours worked. So while construction wages are a significant factor in a project budget, said Frank Callahan, president of the Massachusetts Building Trades Council, they’re not what’s driving costs upward.

“There’s fewer people working on these jobs than 10 or 15 years ago,” he said.

Combined, labor and materials — “hard costs” — account for 75 to 80 percent of the cost of a new building. The rest goes toward “soft costs:” architects and engineers, lawyers and consultants, plus insurance, financing, and the fee developers take to cover expenses and pay their staff, typically 2 to 3 percent of the overall budget.

This is where the region’s tangled permitting process can get expensive. Every month a project waits for zoning approvals means more interest on loans. Every time a planning board orders up revisions means bigger bills to architects. All of it pushes out the date when the rent checks start flowing in to pay everything back.

“Our projects take three or four years,” said Bruce Percelay, chairman of the Mount Vernon Co., a prominent Boston landlord and developer. “You’re carrying all that expense over a long period of time, and you’ve got to apply that into your loan, and therefore numbers trickle down into rents.”

Then there are the add-ons that communities want, but come at a cost.

Green energy codes add 5 to 10 percent to the cost of a new building, developers estimate. They may reduce utility costs over time but must be paid for upfront. Affordable housing requirements add up too. Boston recently set its mandate at 17 percent of units in new buildings offered at income-restricted rents with 3 percent more set aside for rental vouchers, up from 13 percent. That promises to provide much-needed affordable housing but reduces the income those apartments can fetch.

After all that, a building still has to make a profit. Right now this might be the hardest math of all, because the surge in interest rates over the last two years has upended both pillars of construction finance: debt and equity.

Typically, developers borrow roughly half the cost of a project. Interest rates on construction loans have leapt roughly 5 percentage points in the last two years, federal data show. The other half comes in the form of equity – upfront cash from investors in exchange for a cut of the profits.

When rates were low, equity investors in Boston-area housing projects would often accept a return of about 4 percent, developers say. Now? With ultra-safe Treasury bonds offering 4 percent, many of those same investors won’t touch something as complicated as an apartment building for less than 6 or 6.5 percent.

“You can walk down to your local bank and get a (certificate of deposit) at 5 percent,” said Ted Tye, managing partner of Newton-based builder National Development. “If I can do that, why would I take a risk on a $100 million housing development to get a lower return?”

So to attract investors, projects need to be even more profitable, as the cost to build them has surged. There’s only so much developers and contractors can do, Jennette said.

“It’s a math problem where we used to have a bunch of levers to pull,” he said. “We’re running out of levers.”

A DEVELOPER'S PERSPECTIVE

PENCILING OUT A HYPOTHETICAL 170-UNIT RENTAL BUILDING NEAR BOSTON *

Total project cost

$90.8 million

Land

$6.8 million

Soft costs

$15 million

Hard costs

$69 million

Return for investors:

$5.45 million

Average rent per unit

Market rate

153 units

$3,468 per month

Affordable housing

17 units

$1,625 per month

First: Where would you like to build?

The closer you get to the core of the region, the more land tends to cost.

Advertisement

A union electrician for 17 years, Chris Cedrone knows apartments.

“I’ve built so many of them,” he said. “I’m like: ‘I want to live in one of these one day.’”

A few years ago, Cedrone got his chance. Early in the COVID-19 pandemic, he sold his house and traveled before coming back and going apartment hunting. Everything was expensive.

He wound up in Woburn Village, a new complex at the old Woburn Mall, where he pays $2,725 a month for a 700-square-foot one-bedroom, plus $175 more for parking and internet.

There’s a lot the 41-year-old likes about the place: It’s close to family and the highway, there’s a nice gym, and good restaurants are nearby. The complex also has a dog spa, pool, and dedicated work from home spaces, but Cedrone doesn’t really use those.

Even knowing what it cost to build, it was tough for Cedrone to wrap his head around paying nearly $3,000 a month to live on the outer edge of Route 128.

“I can’t believe what they’re getting,” he said. “Everywhere is like that.”

Longtime housing developer Jay Doherty, who has spent decades building the type of apartments Cedrone calls home, fears the crisis will only worsen as building costs keep climbing.

Doherty is CEO of old line Boston development firm Cabot, Cabot & Forbes, and since 1981 has navigated high interest rates, real estate crashes, and the roller coaster of the COVID years. Cost complaints aren’t about greed, he said, they’re about the ability to build anything at all.

What he sees now has him worried.

Cranes still dot the sky, completing projects that mostly kicked off before financing markets turned. The pipeline behind them is drying up.

“What you see in the air, that’s our available next generation of housing for probably five or six years,” he said.

The ones that do get built, he predicted, will be staggeringly expensive.

In 2020, CC&F opened the Overlook at St. Gabriel’s, 550 units at the old St. Gabriel’s Monastery in Brighton. It includes three mid-rise buildings, plus the historic monastery and the restored church itself.

Rent’s not cheap. The average apartment rents for $3,520, with three-bedrooms fetching $8,000, and most residents — many of whom are graduate students — have parents co-sign their leases. But they’d be even more expensive if built today, as Doherty and one of his top lieutenants, Allie Sullivan, explained on a recent morning beneath the bright-white domed high ceiling in that restored church.

Jay Doherty is CEO of Cabot, Cabot & Forbes, a longtime Boston-area development firm that built the Overlook at St. Gabriel’s in Brighton. (Suzanne Kreiter/Globe Staff)

St. Gabriel’s broke ground in 2018 and cost $317 million, or around $576,000 per unit, to build. Today, Doherty estimated, it would cost at least $332 million, or $605,000 per unit. And to generate enough revenue to throw off the 6.25 percent profit that investors now expect, rents would need to average $4,856.

Costs go higher from there. Another project CC&F has underway in the Fenway — taller and framed with steel instead of wood — would cost $781,000 per unit today. At that price, the average rent would need to be nearly $6,400 a month.

“From a human perspective, this is gross. It is. Even as a developer,” Sullivan said. “My son had to move to Rhode Island because he couldn’t live here.”

Of course the alternative — not building — is a big reason why housing costs so much to begin with.

For decades, Eastern Massachusetts has built too little housing, even as high-paying jobs poured into the region. Restrictive zoning, particularly in suburban towns, prevented multifamily construction and the resulting lack of supply has driven both rent and land prices skyward. Now, the cost of housing is a major hurdle for the state’s economy, and a big reason why so many people have left Massachusetts since the start of the COVID pandemic.

Ask people how we should respond, and you get one common answer: Build more affordable housing.

Affordable housing, though, doesn’t cost any less to build than market-rate. Take a project that Trinity Financial is proposing in Charlestown.

It would put 686 apartments and condos — 60 percent of them income-restricted affordable housing — on two city-owned parking lots next to Bunker Hill Community College. In financial plans filed with the city, Trinity estimates the project will cost $495 million, or just under $640,000 per unit.

That’s with free land. Everything else costs the same. Materials, labor, financing.

“Cumulatively, it adds up,” said Kenan Bigby, Trinity’s managing director of development. “That ends up in the project, and the stream of revenue that pays for all of that is the income the property generates,” or the rents.

But affordable units collect less rent than market-rate ones. Trinity’s plans, for instance, include 36 two-bedroom apartments for lower-income tenants, with rents at $1,863 per month, and 24 more for middle-income tenants that would fetch $2,531. That’s barely half the rent on market-rate two-bedrooms, which Trinity estimates will be $5,000.

Kenan Bigby and Abby Goldenfarb of Trinity Financial, which is planning a 686-unit apartment and condo development - much of it income-restricted affordable housing - on two city-owned parking lots near Bunker Hill Community College in Charlestown. (Lane Turner/Globe Staff and Ikon Architecture).

Those market rents do offset the affordable units. But only to a point. The rest of the project will be financed with an array of subsidies — city, state and federal tax credits, grants and loans that together add up to nearly $106 million.

There’s only so much subsidy to go around.

“Federal and state money is not the solution to this problem,” said Marc Draisen, executive director of the Metropolitan Area Planning Council. “That’s not going to make the per-unit cost cheaper.”

Advertisement

So what is?

There’s no one answer. Most people the Globe spoke with offered some variation of “there’s no silver bullet.” But they have a few ideas — ones that, with creativity and a bit of luck, might have a shot at meaningfully bringing costs down.

A big one: Less parking.

Underground garage spaces cost $60,000 to $70,000 apiece. Surface parking lots gobble up valuable land that could be a building site instead. Neither make a ton of sense to urban housing developers building near train stations.

“A lot of our residents don’t have cars,” said Kerr. “We lose money building parking.”

More communities are reducing parking requirements at new buildings; Cambridge last year eliminated them altogether. But many places still require as much as one space per unit.

Why?

Often it’s because of pushback from neighbors worried that newcomers’ cars will grab precious on-street parking, even as they also worry those cars will clog the streets with traffic.

The fact that neighbors get so much say leads some to suggest another potential solution: clearer zoning rules.

Nearly every large building in and around Boston needs a zoning variance or special permit, which in turn requires a series of public meetings and votes. This can take months, even years, and often forces changes to the original design or kills a project entirely.

Those changes may result in a better project, developers acknowledged, but they also take time. Clearer, cleaner rules on what can be built where would make a big difference, Tye said.

“There have been very few communities where there is a very clear path to permitting and approvals,” he said. “For a lot of projects, they entered the permitting process in one economic cycle. They emerge out of it in another.”

So even though they might have permits, no one will finance them. Tye has a project like that, the old Midtown Hotel on Huntington Avenue, where the city approved 325 units in 2021. But until financial markets improve, he said, those 325 apartments are on the shelf, along with almost 23,000 others around the city that have been approved but not yet built.

To help get them started, developers are urging Boston Mayor Michelle Wu to offer breaks on property taxes for buildings that break ground in the next year or two. Lower taxes, they say, would reduce a building’s operating costs, perhaps making it profitable enough to interest investors.

“That’s the biggest weapon the city has,” Mount Vernon’s Percelay said.

It may soon be deployed. Wu herself raised the idea in a recent speech to business leaders, saying the city is “strongly considering” a short-term tax break. More details are expected next year.

But tax breaks, too, would do little to change the actual cost of construction. For that, some say, developers and construction companies need to rethink their entire approach.

Advertisement

Which gets back to that building on the edge of Somerville.

It’s the first project by Lab 9 Modular, a startup with roots in the Netherlands that opened its Littleton factory in the hopes of proving a case for modular construction here.

During a recent tour of the cavernous facility, a worker carried a slab of drywall from a pile and laid it horizontally on a metal frame. Another then clambered on top and nailed it into place. Behind them, a 10-ton robotic crane maneuvered a ceiling onto the open top of a 240-square-foot box.

Two or three of these rectangular boxes — each a bit larger than a standard shipping container — will make up each apartment, and nearly 40 in various stages of construction filled the factory floor, amid piles of steel bracing, metal mesh and sheet rock, ducts and windows and flooring. The factory can finish one or two full apartments a day, and shipments to POAH’s site in Somerville will start soon.

Traditional building is still the best choice for many housing projects, said Lab 9 CEO Niels de Jong. But for some, this industrial-scale approach can bring valuable speed and — at least in this case — considerable savings. Clarendon Hill will cost around $480,000 per unit, said Gornstein, POAH’s CEO, substantially less than a similar-sized project POAH’s building six miles away at the Whittier Street public housing complex in Roxbury, where they are $662,000 per unit.

“There are many, many ways of working on the solution,” de Jong said. “And I’m not saying we can solve the whole crisis. But we are actively trying to help.”

Modular construction is hardly a new idea. The concept of factory-built housing has been around for centuries. It’s fairly common in Europe and Asia, and work recently finished on a 44-story residential building — the world’s tallest modular housing — in suburban London. That building was built by Greystar, which has opened its own modular factory in western Pennsylvania and has six projects in the works in the Mid-Atlantic and Northeast. They’re scouting for sites in Eastern Massachusetts.

“It’s not materially less expensive, but what it is is materially faster,” Kerr said. “You’re building it in half the time.”

Beyond speed, standardized building plans mean lower design costs and less waste. Factory-level quality control limits the headache of construction delays. Weather is not a concern.

Modular’s not perfect. Mass-producing such a site-specific product can be incredibly complex. Trucking costs are huge. And the need for steady work to keep assembly lines humming has proven to be hard in a notoriously boom-or-bust industry.

But the housing crisis gripping so many corners of the US has sparked more experimentation lately, some right around here. Startups are sprouting, and the Metropolitan Area Planning Council and a consortium of cities recently applied for a federal grant to explore building a modular plant in Greater Boston.

On its own, modular housing won’t be enough. Neither will less parking or cleaner zoning or even lower costs for land and labor. Not to fix a housing crisis that has built over decades. Not to build housing that regular people can actually afford.

For that, some say, the region needs to think back to an old way of building housing, one that’s less dependent on profit.

“Housing is a human right” is a common refrain among advocates who put shelter alongside health, safety, and food as a public good that’s worth public investment. But a half-century ago, the federal government largely backed away from funding multifamily housing, said Northeastern University professor and longtime civic planner Ted Landsmark, leaving it up to the private market.

If the market is failing at that job, there could be another shift coming, Landsmark said, one that brings more public dollars back into the production and financing of housing, and not just for public housing for the very poor. It would mark a sea change, Landsmark said, maybe one that’s long overdue.

“The American dream of a single-family home with a gas-powered automobile sitting in a driveway is shifting,” he said. “Urban planning that incorporates multifamily housing … will inevitably prevail.”

Beyond the gilded gate

People in and around Boston are being challenged, in ways never before, to address the region's unprecedented housing crisis. The Globe Spotlight Team probed this question and found yet another crisis: One of consensus and will.

Preview: Data

Graphics: Why it’s so hard to afford housing in Boston

Part 1: Milton

In towns like Milton, home prices are a threat to prosperity. But they don’t have to be

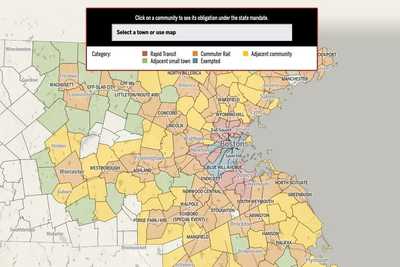

Map

How will the state’s historic rezoning mandate affect your community?

Part 2: Generations

One house, one family, and the fading dream of homeownership

Part 3: Luxury towers

Reckoning with Boston’s towers of wealth

Part 4: Brookline

An identity crisis comes to Brookline

Part 5: Single-family zoning

Reimagining an American ideal

Part 6: The renters

A Boston building, scattered souls, and rent control revisited

Part 7: Construction costs

The $600,000 problem. Why does it cost so much to build housing in Boston, and what can we do about it?

Calculator: Construction costs

Calculator: Penciling out a project

Credits

- Reporters: Mark Arsenault, Andrew Brinker, Catherine Carlock, Stephanie Ebbert, Diti Kohli and Rebecca Ostriker

- Editors: Patricia Wen, Tim Logan, Mark Morrow

- Photographers: Lane Turner, Jessica Rinaldi, Erin Clark, Craig F. Walker, Pat Greenhouse, David L. Ryan, Jonathan Wiggs

- Photo editors: Leanne Burden Seidel and Bill Greene

- Video producers: Olivia Yarvis, Randy Vazquez, and Dominic Smith

- Video director: Anush Elbakyan

- Design: Ryan Huddle

- Development, graphics, and data analysis: Daigo Fujiwara

- Development: John Hancock, Andrew Nguyen

- Digital editor: Christina Prignano

- Copy editor: Michael J. Bailey

- Quality assurance: Nalini Dokula

- Audience: Cecilia Mazanac and Jenna Reyes

- SEO: Ronke Idowu Reeves

- Newsletters: Jacqué Palmer

- Researcher: Jeremiah Manion

© 2024 Boston Globe Media Partners, LLC